Khosla: Wood chips could be part of U.S. energy future

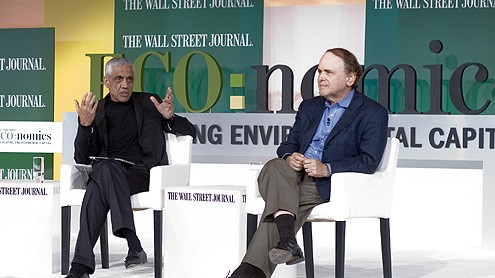

Vinod Khosla, left, of Khosla Ventures and Daniel Yergin of IHS Cambridge Energy Research Associates talk about the future of energy at the Wall Street Journal's Eco:nomics conference in Goleta. (Stephen Nellis photo)

Vinod Khosla has seen the United States’ energy future, and it is wood chips.

Khosla was co-founder of Sun Microsystems and is now a prominent Silicon Valley venture capitalist. He has invested in several tri-county startups in recent years, including Transonic Combustion, an automobile fuel efficiency firm in Camarillo. He also invested in EcoMotors, an engine technology firm, and Soraa, an LED firm, which both started in Goleta.

Speaking at the Wall Street Journal’s Eco:nomics forum at the Bacara Resort & Spa on March 22, Khosla said that the nation’s paper mills, many of which have gone out of business as the Internet crushed the print media industry, are a ripe opportunity for investment. They have much of the processing equipment needed to process raw wood chips into what is know as cellulosic biofuel, fuel that comes from plants but doesn’t eat into food supplies like corn-based ethanol.

“If there are 1,000 paper mills in the country that have gone out of business, you can replace them and their feedstock basins with fuel plants,” Khosla said.

What makes paper mills and woodchips so enticing, Khosla said, is that they are already exist around the country. He said most environmental solutions fail because they can’t scale up to compete with existing technologies whose low prices come in part from immense economies of scale.

Environmentalists, Khosla said, have spent too much time on “hand-wringing about what people should do instead of what they will do. Anything that doesn’t follow the laws of economic gravity either fails or doesn’t scale,” Khosla said. “You have to have the ability to survive and compete at $60, $70 per barrel oil.”

In recent years, the boom in natural gas from shale has proved a setback for a number of renewable energy technologies. Natural gas is used to make electricity that’s cheaper than wind or solar. Carl Pope, the former longtime leader of the Sierra Club, asked Khosla how those price swings, the corn pricing problems that plagued ethanol, affect environmental-minded investors. “Are we entering an era of tremendous volatility, and what does that do to the ability to finance these technologies?” Pope asked.

“With volatility, you end up demanding shorter payback periods,” Khosla replied. He went on to say that the corn-based ethanol market was a poor example because it’s where two volatile markets — food and energy — come together. Wood chips aren’t food and aren’t easily transportable like natural gas, Khosla said. “The 20-30 year history of woodchip prices is stable. With woodchips, you can’t ship them effectively more than 30 miles, so there’s very little volatility,” Khosla said.

Another audience member at the forum asked Khosla whether biofuels were doomed if oil companies defeated proposed renewable fuel standards for automobiles, as they are working to do.

“Oil companies are hoping they can get renewable fuel standards to go away. That will hurt,” Khosla said. “I do believe cellulosic biofuels can compete without that standard.”

Khsola made the case for broad investment in renewable energy as a portfolio hedge. Moral reasons aside, it’s a financially prudent use of capital. “We don’t have a peak oil problem. We don’t have a peak gas problem. Depending on the price, the supply will be there,” he said. “We should look at the environmental issue as an insurance issue. We insure against terrorism. We insure against nuclear proliferation. We insure against flooding, we insure against earthquakes. Why not insure against climate change?”