CalAmp bumps up offering to $150M

IN THIS ARTICLE

- Latest news Topic

- Staff Report Author

By Staff Report Friday, May 1st, 2015

Taking advantage of record low interest rates, CalAmp, based in Oxnard, has priced an offering of $150 million in convertible notes due in 2020.

The company, which posted record revenues of $250.6 million on strong demand for its wireless products and services, said it increased the offer from $125 million announced initially; the interest rate will be 1.625 percent and based on demand the offering could be increased by an additional $22.5 million. It is expected to close May 6. All the additional allotments are exercised. The $172.5 million offering would be one of the largest convertible debt deals by a company based in the region in the past several years.

CalAmp said that assuming the maximum offering, $13.4 million, will be used to purchase financial instruments to hedge against future market fluctuations with about $146 million available to fund future activities including possible acquisitions.

CalAmp has been growing quickly thanks to a new suite of software, equipment and services geared toward fleet management and the heavy equipment sector. The company’s shares have mounted a comeback in recent years as it diversified from a wireless components maker to offering a range of products that help companies track where their fleets or other equipment are and how they are being used.

The company, which has virtually no long-term debt, will have quite a war chest when the deal closes. At the end of the 2015 fiscal year on Feb. 28, it had $44 million in cash and marketable securities on hand after generating more than $28 million in cash for the year. Net cash to the company from the debt offering would put its cash levels at roughly $190 million.

Related Articles

Thursday, June 3rd, 2021

Thursday, June 3rd, 2021

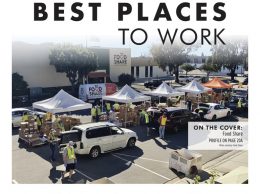

Register now for our Best Places to Work awards reception and panel discussion

Wednesday, March 3rd, 2021

Wednesday, March 3rd, 2021