The knives come out at the Santa Barbara Public Market

IN THIS ARTICLE

- Columns Topic

- Elijah Brumback Author

By Elijah Brumback Friday, May 1st, 2015

In an update to the Business Times’ April 3 story on the trials and tribulations of the Santa Barbara Public Market, some tenant angst is starting to spill over.

While a few tenants, including Rori’s Artisanal Ice Cream and Empty Bowl, are exceeding revenue expectations, at least one merchant feels misled by claims project developer Marge Cafarelli allegedly made at the time leases were signed.

According to a suit filed April 1 in Santa Barbara County Superior Court, owners of The Pasta Shoppe claim Cafarelli “falsely and fraudulently” induced the handmade pasta maker into signing its lease on Jan. 11, 2013. Now the company is looking to break that agreement and is seeking damages.

Among other allegations, the suit states Cafarelli promised and never delivered on foot traffic of 1,500 to 2,500 people per day, a grand opening ceremony with Gov. Jerry Brown and the additional retail space on Victoria Street would be leased by the market’s opening.

Additionally, owners of the Pasta Shoppe claim they’ve suffered damages of more than $25,000 due to overcharges on the base rent of its triple-net lease.

Indeed, Gov. Brown never showed and there was never a grand opening and ribbon cutting ceremony for the market. The Pasta Shoppe owners also claim foot traffic at the market doesn’t break more than 1,000 people per day.

Cafarelli declined to comment on the suit, citing the pending litigation, but said she will file a legal response on May 4.

“Many of the businesses have made changes to do better business,” she said. “Will there be some attraction? Sure. But this is a start-up just like any start-up and what I won’t do is contribute to a negative discourse about the Public Market.

“People are going to like it or dislike for a whole host of reasons,” she said. “But the facts are that the absolute majority of tenants are trending in the right direction and are doing well.”

The Business Times previously reported that within a few months of opening, the Public Market experiment had some of the tenants praying to the gods, hoping they’d make payroll, and others admit it’s still tough today.

According to Cafarelli, every tenant is current with their rent and no one is in default of their lease.

“It was kind of a shock for Santa Barbara,” Cafarelli previously told the Business Times in regard to the development’s reception. “But we stayed patient and I think the community is really adopting and supporting what we do. Business, month-over-month, is getting better.”

The public market development, which includes the 37-room luxury condo complex Alma del Pueblo, could have been successful without the residential element, according to Cafarelli, though she declined to disclose a revenue figure.

Deals of the week

• Smart & Final is more than doubling its footprint, taking roughly half of the Lemon Grove Plaza in Oxnard.

The company recently signed a lease for 43,200 square feet at the center and is re-opening as a Smart & Final Extra concept.

The company had been operating in a roughly 16,000-square-foot space within the center for almost 30 years. Smart & Final Extra is larger than the company’s traditional warehouse stores, combining discount fresh produce and large club-sized products like those at Costco or Sam’s Club.

Smart & Final was acquired by private equity firm Apollo Management in May 2007. Later that year, the company purchased 27 Southern California Henry’s Farmers Market stores and eight Texas Sun Harvest stores. The company subsequently sold the Henry’s and Sun Harvest stores to Sprouts Farmers Market in early 2011. Smart & Final was later acquired by Ares Management, a private equity firm, in 2012 and went public last year.

Smart & Final has 250 stores in California, Oregon, Washington, Arizona, Nevada, Idaho and northern Mexico. There are several located up and down the Central Coast that are continuing to expand.

Pam Scott of Lee & Associates Central Coast brokered the deal. Scott previously brokered the Smart & Final Extra lease at the new Hollister Village Plaza retail center in Goleta.

A 10-unit apartment complex in Ventura recently sold for its full asking price of more than 1.7 million. The property, located at 154 Hemlock St., sits six blocks from downtown and is less than a mile from the pier.

The property was bought by a pair of San Francisco investors who own another building in Ventura. The new owners pulled part of the purchase funds from a refinancing at the other property and put it toward the down payment on the Hemlock building, according to Channel Group Principal Nick Henry, who brokered the deal for the sellers.

The location, high rental demand market and immediate upside in rents, elicited six bids for the two-story complex, with partial ocean views.

Related Articles

Thursday, June 3rd, 2021

Thursday, June 3rd, 2021

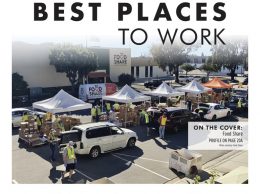

Register now for our Best Places to Work awards reception and panel discussion

Wednesday, March 3rd, 2021

Wednesday, March 3rd, 2021